China 19-Point Stimulus Plan to Revive Economy 2025 is facing renewed pressure as industrial output and retail sales growth weaken, prompting Beijing to announce a comprehensive 19-point stimulus package aimed at stabilizing growth and restoring confidence. The move underscores the urgency of countering sluggish domestic demand, a faltering property sector, and external headwinds such as U.S. tariffs and geopolitical tensions.

Industrial Output and Retail Sales Slowdown

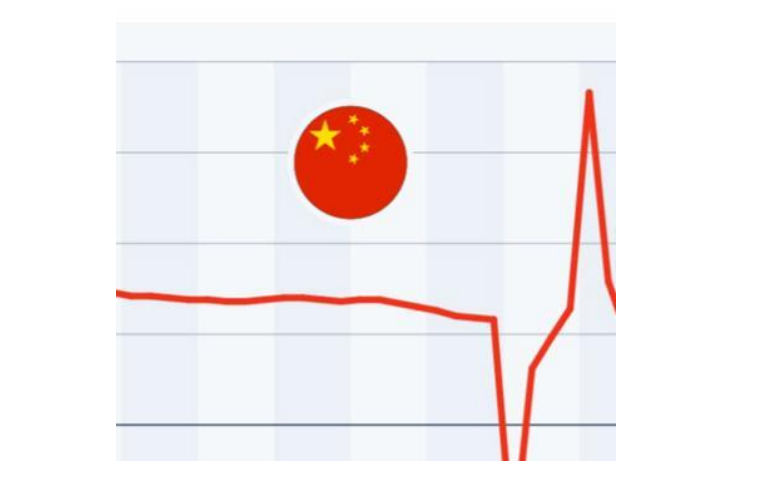

China’s latest economic data revealed that both industrial production and retail sales fell short of expectations in August 2025. Industrial output has cooled as global demand softens, while retail sales growth hit its weakest pace since November 2024. Analysts note that consumer sentiment remains fragile, with households prioritizing savings over spending amid uncertainties about jobs, wages, and housing prices.

The retail slowdown is especially concerning for policymakers. China 19-Point Stimulus Plan to Revive Economy 2025 has long emphasized a shift toward a consumption-driven growth model, reducing reliance on exports and infrastructure investment. Yet, weak household spending highlights lingering structural challenges, particularly in urban housing markets and rural income levels.

The 19-Point Stimulus Blueprint

In response, the Chinese government unveiled a sweeping 19-point economic stimulus package. The plan is designed to inject momentum into domestic activity while strengthening key sectors that can deliver long-term resilience. Major highlights of the stimulus include:

- Finance and Lending Support: Measures to improve liquidity for small and medium enterprises (SMEs), as well as targeted credit lines for innovation-driven companies.

- Tourism Boost: Expanded domestic tourism subsidies, infrastructure upgrades at major destinations, and visa relaxations to encourage international inflows.

- Healthcare Expansion: Increased funding for hospitals, elderly care, and pharmaceutical innovation to strengthen the health system and create new jobs.

- Consumption Incentives: Tax breaks for household purchases, particularly in automobiles, electronics, and green appliances, to spur demand.

- Property Market Relief: Easing restrictions on home purchases in select cities, alongside more flexible mortgage policies to stabilize real estate.

Officials emphasized that the measures are intended to balance short-term demand support with long-term structural upgrades in productivity and innovation.

Balancing Growth and Stability

The timing of the stimulus is critical. China’s growth target of around 5% for 2025 is increasingly difficult to achieve as domestic demand lags and export markets soften. The 19-point plan, however, signals Beijing’s determination to defend growth while avoiding excessive reliance on debt-driven infrastructure spending—a strategy used in earlier slowdowns but now viewed as unsustainable.

Economists suggest that the package reflects a more balanced approach. By focusing on services such as tourism and healthcare, the government is attempting to diversify growth engines. At the same time, targeted financial support for SMEs is expected to help protect employment, a core political priority.

Global Implications of China’s Slowdown

China 19-Point Stimulus Plan to Revive Economy 2025 economic trajectory carries major implications for the global economy. As the world’s second-largest economy and a crucial hub for supply chains, weaker Chinese demand can ripple through commodity markets, manufacturing, and global trade flows. Already, commodity exporters are watching China’s industrial slowdown closely, with prices of metals such as copper and aluminum showing signs of pressure.

Meanwhile, multinational firms reliant on Chinese consumers are facing challenges in sales. Global automakers, luxury brands, and technology companies may all feel the effects of sluggish household spending. At the same time, the new stimulus measures could provide a temporary lift in these sectors, depending on the scale and pace of policy implementation.

Risks and Challenges Ahead

Despite the ambitious plan, several risks remain. China’s property sector, a major pillar of the economy, continues to struggle with high debt, unfinished projects, and weak buyer confidence. Without a clear turnaround in real estate, broader consumer sentiment may remain subdued.

Additionally, external headwinds persist. Higher U.S. tariffs on Chinese goods, rising trade tensions, and geopolitical frictions could limit the effectiveness of domestic stimulus. Global investors are also closely monitoring China 19-Point Stimulus Plan to Revive Economy 2025 financial stability, particularly given concerns about local government debt and shadow banking exposure.

Outlook for 2025 and Beyond

China’s 19-point stimulus package marks one of the most comprehensive economic interventions in recent years. While it may help cushion short-term pressures and stabilize growth, the real test lies in whether it can boost consumer confidence and drive sustainable structural transformation.

For now, China 19-Point Stimulus Plan to Revive Economy 2025 is walking a tightrope: stimulating demand without inflating debt, propping up the property market without reigniting speculative bubbles, and supporting industries while ensuring fair competition. The coming months will be crucial in determining whether these measures can steer the economy back toward stable, sustainable growth.