New Orders Dip and Hiring Slows Amid Regional Tensions and Rising Costs

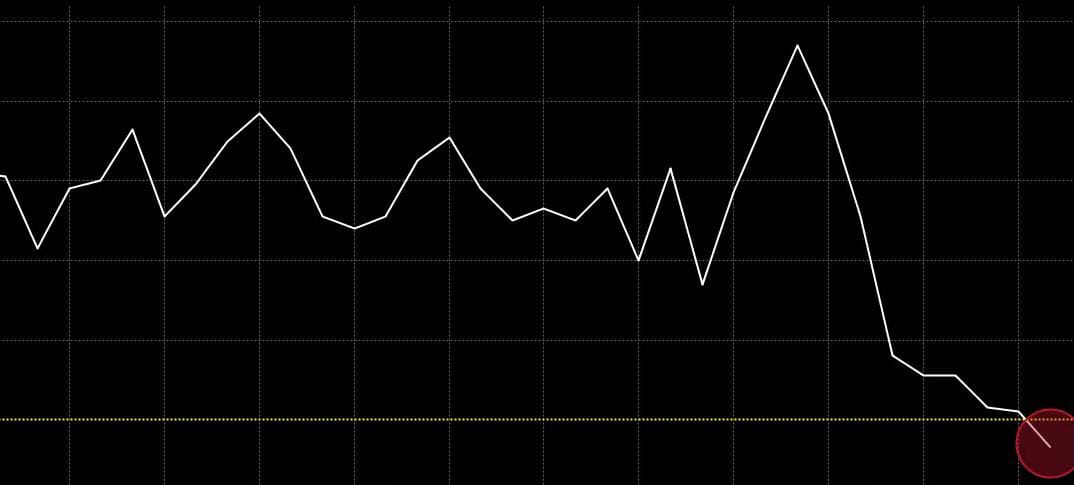

The UAE Business Growth non-oil private sector recorded its slowest growth in over four years in July, as new business orders declined and hiring activity softened, according to the latest Purchasing Managers’ Index (PMI) report released by S&P Global.

The PMI dropped to 52.9 in July, down from 53.5 in June, marking the lowest reading since June 2021. While a score above 50 still reflects economic expansion, the pace of growth has clearly slowed, reflecting mounting economic pressures and geopolitical uncertainties.

Geopolitical Tensions and Inflation Curb Market Optimism

A major contributor to the subdued business sentiment was the ongoing crisis between Israel and Iran, which escalated in mid-June and cast a long shadow over business activity into July. Despite a ceasefire, uncertainty persisted, prompting caution among clients and investors alike.

“Survey members partly link this slowdown to tensions between Iran and Israel, which has made some clients hesitant to spend,” the report stated. Market observers noted that these geopolitical factors had a tangible impact on decision-making across key non-oil sectors in the UAE Business Growth.

Mounting Inflation Pressures Drive Price Hikes

Locally, businesses also grappled with a faster pace of cost inflation, compelling many to increase their prices. This rise in operational expenses contributed to a “fresh rise in average prices charged”, further challenging business growth and profitability.

There were also widespread concerns that market saturation was making it harder for companies to secure new business. “Markets are becoming more crowded,” the report noted, indicating rising competition in key sectors.

Weakest Hiring Uptick in Four Months

The report also showed that job creation had slowed considerably, with companies cautious about expanding their workforce amid rising costs. July marked the weakest employment growth in four months, despite an increase in outstanding business.

S&P Global analysts attributed this to a wait-and-see approach adopted by many companies, as they monitor both global developments and local economic signals before committing to further hiring or expansion plans.

Hope for Recovery if Tensions Ease

Despite the current slowdown, experts believe the outlook could improve if regional conditions stabilize.

“Should regional tensions ease, we may see a recovery in sales growth in the coming months,” said David Owen, Economist at S&P Global Market Intelligence.

He added, “This would also be supported by the subdued price environment, with input costs rising only modestly despite the pace of increase reaching a three-month high.”

Minimal Direct Impact from U.S. Trade Policies

While the broader economic challenges are largely regional and inflation-driven, international trade policies could also play a secondary role. Notably, GCC companies’ revenue exposure to the U.S. remains limited, but some sectors could feel indirect impacts.

The U.S. maintains a trade surplus with the UAE Business Growth, exporting goods worth $27 billion last year compared to $7.5 billion in imports. However, John (name not fully specified) warned of a potential ripple effect from the 25% tariff imposed by the U.S. on global aluminum and steel imports.

“This is significant given that the UAE Business Growth is the third-largest aluminum exporter to the U.S.,” he said, highlighting a potential concern for one of the country’s key export sectors.

Conclusion

While the UAE’s non-oil economy remains in expansion territory, July’s figures reveal a clear cooling in business momentum. Regional instability, rising inflation, and stiffer competition are creating a cautious environment for growth. However, with geopolitical tensions potentially easing and global markets stabilizing, businesses and analysts remain hopeful for a turnaround in the coming months.